Submit your email below to subscribe to the Washington Wire:

Support CTA Relief

The House Small Business Committee is holding a hearing on the Corporate Transparency Act later this month. One witness will be Carol Roth, a bestselling author and small business advocate who has helped lead the charge against the poorly crafted law.

We’ve covered the CTA at length over the past few years but the bottom line is that while reporting under the CTA started already and the deadline is the year’s end, only a tiny percentage of the targeted 33.6 million small businesses even know it exists. That’s bad because a failure to file is accompanied by thousands in fines and two years in jail.

Carol Roth’s appearance before the Small Business Committee will help us get the message out and she recently issued the following request:

I have been invited to testify in front of the House Small Business Committee on April 30th against the CTA BOI rule that is unfairly targeting small business owners. I am honored to take this step to fight for the Constitutional rights of small businesses owners across the country.

I am also able to submit statements for the record from other small business owners. I want to submit at least 100, but as many as possible, to make an impact. If you own a US-based small business, please consider submitting a statement to me before April 19, 2024.

To make this easy for you, I have created a page to take the submissions, which includes a sample letter (you can borrow as much or as little as you want for the letter- any personal insights are welcome). You can access that here.

As an S-Corp reader, we hope you’ll consider submitting a statement to Carol before the end of the week – it only takes a few minutes and helps ensure your voice is heard on this important issue.

And if you happen to live in Ohio, then it’s doubly important that you get engaged. Senator Sherrod Brown (D-OH) is the chair of the Senate Banking Committee and is the key to moving the Tim Scott delay bill through that body. If Senator Brown supports the bill, it will pass the Senate.

So submit your statement, contact the Brown office, and make sure your voice is heard!

Main Street on the Hill

S-Corp and its friends at the National Federation of Independent Business hosted a Tax Day briefing for Hill staff and other stakeholders yesterday. The topic: the massive tax hikes threatening Main Street at the end of 2025.

As readers know, the expiration of the Section 199A deduction coupled with significant increases in the marginal rates paid by the 95 percent of businesses nationwide is a significant challenge facing Main Street and Congress next year. We know Congress is going to have to act, and we know the issues in play are new to most of the staff and Members currently serving. The education challenge is daunting and yesterday’s briefing is just the first of many education sessions we have planned through the end of the year.

The briefing kicked off with a panel on the history and economics of Section 199A, featuring NFIB’s Vice President for Federal Relations Jeff Brabant, S-Corp President Brian Reardon, and EY QUEST Co-Director and veteran tax pro Bob Carroll.

Brian ran through the ABCs of the pass-through structure, and explained why it remains the choice for virtually every business currently operating in America. The bottom line is that while pass-throughs pay tax once at the owner level on income when it’s earned, C corps pay tax once at the entity level, and once again when those profits are distributed to shareholders.

So why would any company opt in to the distortive corporate double tax? As Brian laid out, that second layer of tax is increasingly discretionary, especially for public companies whose shareholders include qualified retirement plans, charities and endowments, and foreign investors.

As a result, the double tax is largely reserved for private companies only, not public ones, meaning businesses engaged in the same industries can face tax burdens that differ significantly depending on how they are organized. The Section 199A small business deduction is designed to help bridge this gap.

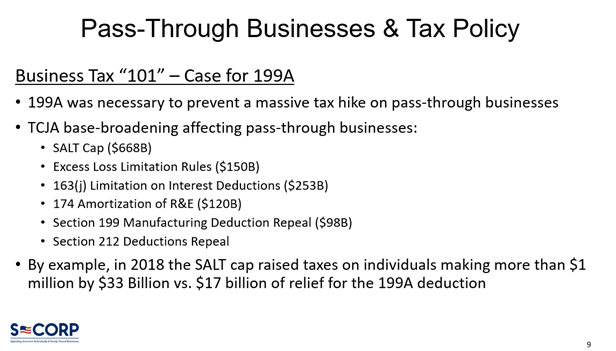

Another key point was the reason why 199A is necessary. Parity is important, as is encouraging economic growth and job creation. Central to the Main Street advocacy back in 2017, however, was the desire to avoid a massive tax hike. That’s because the base broadening included in the TCJA’s corporate reforms affected not only C corporations but pass-throughs too.

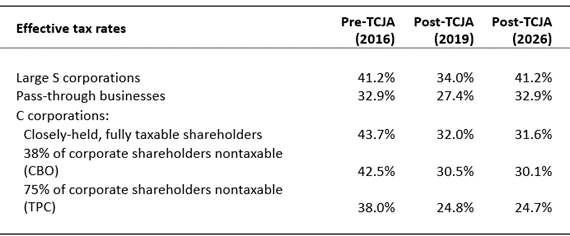

On the parity front, EY’s Bob Carroll presented an earlier study quantifying how the marginal rates faced by pass-throughs and C corporations vary depending on their size, the profile of their shareholders, and the presence of 199A.

The clear lesson of this table is that without 199A, private companies will be a significant disadvantage compared to public companies post-2025.

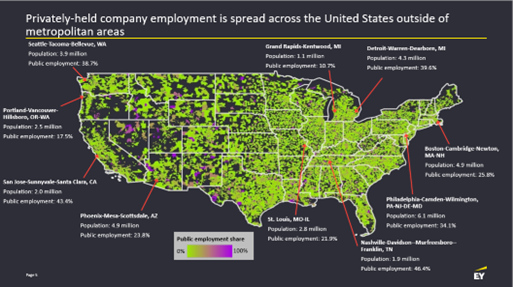

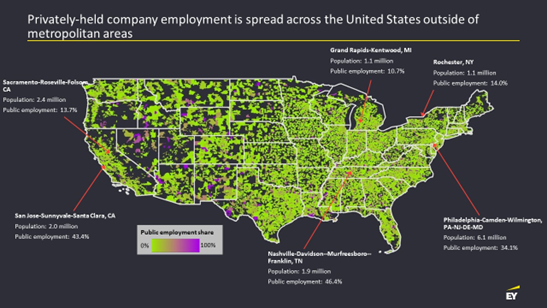

This disadvantage has geographical implications. As Bob’s work shows, private company employment is more evenly spread across the country. Ensuring parity for Main Street businesses is critical to the economic health of thousands of communities.

The day closed out with a presentation from David Winston, founder of the polling and research firm The Winston Group. David summarized the results of his latest polling which found that American voters in key swing states strongly oppose raising taxes on Main Street businesses and are concerned that any tax hikes would be passed on to consumers in the form of higher prices.

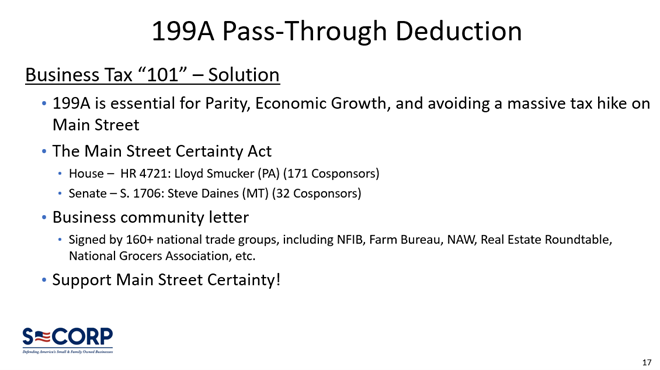

Which all leads us back to the focus of our advocacy, the Main Street Certainty Act. We are up to 171 cosponsors of the Smucker bill in the House, and the Smucker staff was on hand to help educate staff on the issue.

So thank you to NFIB, EY, the Winston Group, the Ways and Means Committee, and to the dozens of Hill staff who came out on Tax Day to learn about business taxation and the importance of 199A. When it comes to advocating for Main Street Certainty and a permanent 199A small business deduction, we’re just getting started.

199A Takes Center Stage

As we wrote earlier this week, it’s a busy April for tax policy. The packed agenda kicked off Tuesday with a hearing at the House Small Business Committee entitled, “Exploring the Adverse Effects of High Taxes and a Complex Tax Code.” It was the perfect opportunity to highlight the tax priorities that are top of mind for the Main Street business community and did not disappoint.

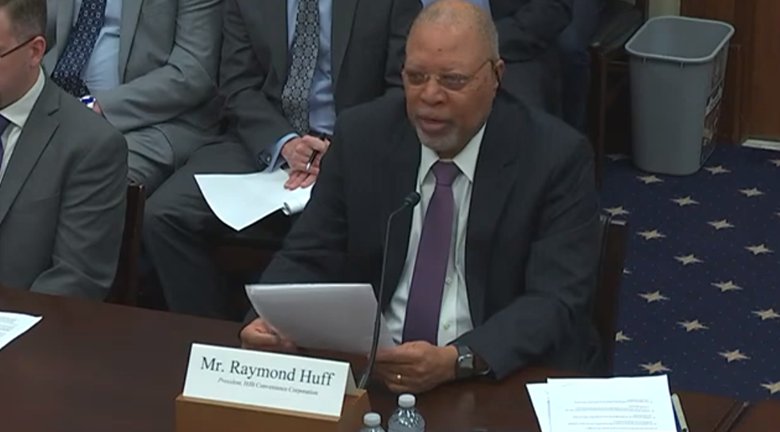

The hearing had a number of high points but we’ll flag just a few, starting with witness Raymond Huff, President of HJB Convenience Corporation based in Denver, CO.

Asked by committee Chair Roger Williams how his business utilizes the Section 199A deduction – and the opportunities afforded to it by keeping more of its hard-earned money – Huff responded:

Having those extra funds, I then invested in 2019 in additional technology that allowed my stores to stay open during the Covid pandemic. So 199A and bonus depreciation helped me tremendously over those two years.

Mr. Huff’s account mirrors those of millions of small business owners across the country. The deduction isn’t pocketed by business owners – it is reinvested in the form of new workers and equipment that help them grow. These businesses already face a challenge when competing with public companies, and absent the Section 199A deduction that challenge will grow larger.

Representative Beth Van Duyne (R-TX) pressed the point further and addressed the argument that the Tax Cuts and Jobs Act was merely a bailout for “wealthy corporations and one-percenters.” She asked Mr. Huff if he felt his business fell into one of these two categories – here’s his response:

No, I’m definitely not either. I’m a small business owner who goes to work every day, trying to make a dollar and pay my employees, and grow my business. But I’d like to one day be wealthy and be one of those things!

The next day, the House Ways & Means Committee convened for a hearing titled, “Expanding on the Success of the 2017 Tax Relief to Help Hardworking Americans.” Early on the panel heard from Michael Ervin, founder of the Coal River Coffee Company and a member of the National Federation of Independent Business:

Businesses like mine were able to benefit from the newly minted small business deduction, also known as the 199A deduction. This provision has allowed me to deduct up to 20 percent of my business income which has let me invest in my business, my employees, and in my community.

We’ve been able to increase my employees’ hourly wages, invest in equipment grow from a single location to four iterations, create a mobile location, and sell my Main Street roasted coffee internationally.

…However, in less than two years our business will be facing a huge, significant tax hike. Unless Congress acts to extend and make permanent the small business deduction, not only will my 20% small business deduction go away but my marginal tax rates will increase. These tax increases do not exist in a vacuum – my larger competitors like Starbucks and Tim Hortons are organized as C corporations and pay a 21 percent corporate rate, which is permanent. If the small business deduction lapses and my marginal rates increase, I could be staring at an effective tax rate of nearly 45 percent, when you combine federal and state income taxes.

As we’ve written before, one of the challenges facing the US economy is the ongoing consolidation of economic activity into large, public companies and away from Main Street. That consolidation means fewer jobs and more boarded up store fronts in thousands of communities nationwide. In response to Representative Vern Buchanan (R-FL) question that “it’s not like you take all that money home and put it under your mattress,” Mr. Ervin responded:

If we don’t have that deduction, there are some things that I’m personally going to lose as a business owner. One of those in particular is giving back to my community. We do a lot of philanthropic work; one example is that we have a partnership with the West Virginia Collegiate Recovery Network and with that partnership we have developed a coffee roast that we sell, and the profits go directly to a scholarship for people that have gone through recovery; this helps them and rewards them for their progress. That would be threatened in a major way.

Congressman Lloyd Smucker – the lead champion of legislation making the Section 199A deduction permanent – also commented:

Main Street businesses employ 60 percent of all private sector employees, and they’ll face a dramatic increase in taxes. If we do away with 199A, a 43.4 percent federal tax rate will be the top tax rate for them. Raising their taxes it would result in reduced wages, reduced benefits for workers, certainly reduced investment in the business, and other impacts to our growth.

Our recent work with EY confirms these data points and highlights just how much is at stake. The businesses facing these massive tax hikes are the ones that supply the majority of jobs nationwide, with many congressional districts relying on pass-through employers for over 75 percent of their jobs.

By our count, the Section 199A deduction was mentioned 61 times throughout the hearing, a reflection of just how important this provision is to millions of businesses nationwide.

So a big thanks to Chairmen Roger Williams and Jason Smith for putting a spotlight on 199A. We look forward to carrying that momentum into next year and securing a favorable outcome for the Main Street business community.

A Taxing Month for Lawmakers

Congress is back in session this week for what promises to be a busy April for tax policy. Here is a quick overview of what’s happening.

Smith-Wyden Bill in Senate

The big-ticket item is the $80 billion Tax Relief for American Families and Workers Act. This bill easily passed the House back in January but has remained stalled in the Senate since.

That’s largely due to Republican tax writers’ objections over the structure of the child tax credit, among other items. As Politico reported this morning:

Key Senate Republicans, including the ranking member of the Finance Committee, Sen. Mike Crapo of Idaho, and the two tax writers running to be next GOP leader in the chamber, Sens. John Cornyn of Texas and John Thune of South Dakota, all continue to have issues with the Wyden-Smith bill, complicating its chances of getting passed.

Republicans have asked Finance Chair Ron Wyden to hold a markup but he has resisted such calls to date. Leader Schumer, meanwhile, sent a note to his colleagues Friday outlining the Senate’s agenda and while he did mention the tax bill, it was only in the context of a longer list of issues that might be considered. Again from Politico:

There are also close to a dozen items listed in that “weeks and months ahead” bucket, and not all that much floor time left in 2024, in no small part because it’s a presidential election year — so it remains difficult to know just how much of a priority the tax bill will be for Schumer.

With time getting short – Tax Day is approaching and the business and Child Tax Credit provisions are retroactive to last year – it appears taking the bill directly to the Senate floor is the only viable option. Scheduling a markup at this late date is unlikely and Senate Republicans remain firm in their position despite the best efforts of the business community.

It’s not the normal path for a tax bill, but at this point in the calendar, it seems to be the only way forward.

Tax Policy Hearings

While the Smith-Wyden bill drama plays out in the Senate, several hearings are scheduled in the House that are worth flagging. The general sense is that the conversation is beginning to turn to next year and the expiration of the TCJA’s individual and pass-through provisions.

- House Small Business Committee on Tax Policy: Shifting the discussion to next year and the fiscal cliff, the House Small Business Committee convenes for a hearing Wednesday (April 10th) entitled, “Exploring the Adverse Effects of High Taxes and a Complex Tax Code.” The witness list includes several small businesses and a professor from Purdue. Should be interesting.

- Ways & Means on TCJA: The following day, the House Ways & Means Committee has a hearing to “highlight the benefits of GOP tax reform and discuss the path forward for tax policy ahead of 2025.” We’re looking forward to plenty of firsthand accounts about how the bill has helped Main Street employers and American families and will be watching closely.

- House Small Business on CTA: Not strictly tax-related, the House Small Business Committee convenes again on April 30 to discuss FinCEN’s implementation of the Corporate Transparency Act. Given that the vast majority of entities affected by the CTA – over 30 million – are small businesses, the panel is the ideal venue to bring concerns over the new data collection regime to light.

Main Street Tax Day Briefing

Finally, the S Corporation Association is teaming up with NFIB to host a Tax Day briefing on the looming tax threat faced by Main Street businesses. Attendees will get a crash course on the importance of Section 199A and other key provisions, the sizeable role played by private businesses in supporting virtually every community across the country (spoiler alert: it’s big), and survey results on how voters feel about these and other topics.

So a busy month for Americans rushing to beat the April 15th tax filing deadline and lawmakers on Capitol Hill as well. As always, we will be out there working to make sure Main Street gets a fair shake.

C Corps for Everybody?

S-Corp’s mantra for tax reform is “S corps for everybody!” Tax all businesses once, tax them when the money is earned, tax them at a reasonable rate, and then leave them alone. In other words, tax them like S corporations. Moving the Tax Code towards what we call a “single tax system” would level the playing field for all types of businesses while eliminating the complexity and distortions created by the double corporate tax.

This approach contrasts completely with the vision outlined in last week’s paper by Kyle Pomerleau and Don Schnieder (P-S). There are lots of moving parts here, but the short version is they would use next year’s fiscal cliff as an excuse to cut taxes for public C corporations while raising them on Main Street businesses. If you’ve been wondering how the corporate sector was going to respond to next year’s looming tax hikes on pass-throughs and individuals, look no further.

Tax Cuts for Me, Tax Hikes for Thee

Public corporations have three advantages over private companies regardless of how those private companies are organized:

- They have access to cheaper capital through the public equity and debt markets;

- Their shareholders often pay little or no shareholder level taxes; and

- They aren’t affected by the estate tax.

By contrast, access to capital is a huge challenge for private companies. With few exceptions their shareholders are always individuals or trusts who are fully taxable, and every private company of any size spends a considerable amount of time and resources trying to manage around the estate tax.

This is a tax discussion so we’ll set aside the first point for now, but challenges two and three are products of a poorly designed tax code. Any tax reform plan worth considering would seek to address those issues.

To their credit, P-S would eliminate the estate tax. That helps, particularly in the context of businesses hoping to continue a legacy of family ownership. They then step all over that decision by either (Option 1) raising taxes on pass-through businesses while lowering them for C corporations or (Option 2) forcing all larger private companies into the double corporate tax.

What would the corporate rate be under their plan? 21 percent. What is the double tax under their plan? 23.8 percent. They start by assuming the TCJA’s corporate relief remains in place and then proceed to offer America’s largest public companies even more benefits by extending full expensing, curbing the impact of the interest deduction cap, eliminating the corporate AMT, and other changes.

Pass-through businesses don’t fare quite as well. P-S would either repeal the 199A deduction outright – they mention this several times lest it escape our notice – or replace it with a “return on capital formula” that’s so narrow and laughably complex as to be beneath discussion.

They also would raise taxes on pass-throughs by allowing the current top rates to revert to their pre-TCJA levels while reducing their income thresholds to new, lower levels. The result would subject pass-through businesses to higher rates imposed on a broader base of income. Just to be clear, those are higher rates and a broader base compared to their pre-TCJA levels, not current law.

This treatment is apparently justified by their observation that pass-throughs are making out like bandits under the TCJA:

Although lawmakers were correct to be concerned about how differences in the taxation of pass-through businesses and C corporations affect behavior, Section 199A reduced the statutory tax rate on business income far below the tax rate on labor compensation, increasing the incentive to reclassify income from labor compensation to capital income. It also increased the competitive advantage of pass-through businesses over traditional C corporations, discouraging companies from incorporating.

So many mistakes in one paragraph. Section 199A doesn’t discourage “incorporation” (S corps are corporations too); 199A reduced the effective rate, not the statutory rate (it’s a deduction); and P-S offer no evidence for their reclassification claim because it doesn’t exist. We are aware of no post-TCJA study finding unusual levels of workers shifting to independent contractor status.

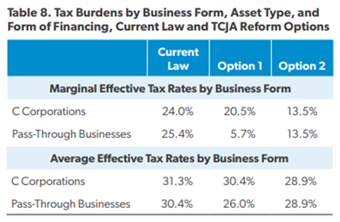

More to the point, “worker versus pass-through” is not the critical comparison here. S corps don’t compete with workers, they hire them. S corps compete with public C corps, and here is where P-S’s own calculations belie the notion that pass-throughs have a rate advantage. Here’s the key portions of Table 8:

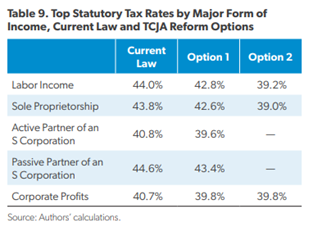

And here’s Table 9:

Neither table reveals a demonstrative advantage for pass-throughs. If anything, they reveal rough rate parity. Moreover, the tables skip over several important details, such as the fact that the pass-through tax burden includes smaller companies paying the lower rates, whereas the corporate tax is imposed on large public companies almost exclusively. They also ignore that the 39.8 percent rate for corporations only applies to private companies whose shareholders are fully taxable, as most public company shareholders don’t pay the full tax so their actual effective rate is much lower than what’s reported here.

Tax Policy Center on Shareholders, Again

That last point is very, very important. One of the head scratching aspects of P-S is their total neglect of the damage the double corporate tax does to the economy. They simply don’t mention it, let alone reflect on its implications. Preserving the current corporate treatment, regardless of how distortionary, was apparently their starting point.

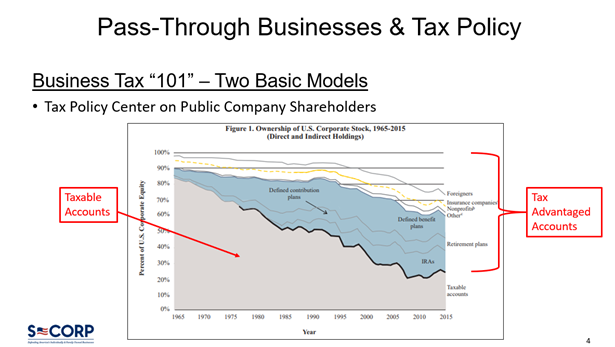

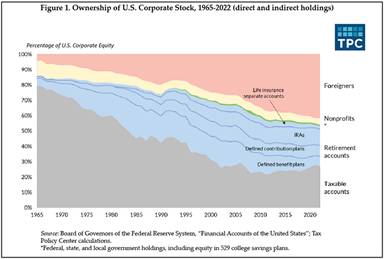

And distortionary it is. Just this week, the Tax Policy Center released a more fulsome version of its 2016 analysis of how the profile of corporate shareholders corporations has shifted in recent decades. The profile has migrated from mostly taxable individuals to being dominated by tax exempt foreign investors, retirement accounts, and other tax-exempt entities.

If you separate the business community into public and private companies, then the blue, yellow and pink shareholders are almost universally reserved for public companies. You don’t get a lot of sovereign wealth funds investing in smaller, private companies.

So while the percentage of taxable shareholders of public companies has dropped, the profile of private company shareholders has remained the same – fully taxable. As authors Rosenthal and Mucciolo write:

First publicly reported in 2016, the pronounced shift from taxable to tax-exempt shareholders complicates tax policy. Policymakers who seek to increase shareholder taxes, for instance, must grapple with a relatively small group of taxable accounts. Policymakers pursuing corporate tax cuts could send a large share of the benefit to foreign investors, at least in the short run. And policymakers seeking to stem corporate stock buybacks must address the tax advantages of buybacks over dividends to foreign shareholders — and to a lesser extent to domestic shareholders.

P-S would preserve this disparity as is, with public corporate shareholders paying little to no second layer of tax while the shareholders of private companies pay the full boat. They then compound this inequity by arguing that all larger pass-through businesses should be forced into the corporate double tax.

What’s interesting is that P-S acknowledge the importance of reducing distortions generated by the Tax Code, and then promptly ignore the role the double corporate tax plays here. They observe:

Timing of Realization. The current tax system relies, in part, on a “realization” principle. For administrative convenience, taxpayers are often taxed only when they realize income. For example, capital gains and losses are counted only when a taxpayer disposes of an asset. As a result, taxpayers have an incentive to hold off on selling appreciated assets and accelerate the sale of an asset to realize a loss. Ideally, taxation would not distort transactions like this.

This failure has geographic implications. As our work with EY has shown, public company employment tends to be concentrated in city centers and the coasts, whereas private company employment, including pass-throughs, is spread more evenly across the country. By further distorting the Tax Code in favor of public companies, P-S would harm large parts of the country.

The irony is that this is why S corporations were created in the first place. Congress back in 1958 recognized that closely-held businesses were disadvantaged under the double corporate tax and made the single tax system more widely available in response. Today’s rates are different but the essential challenge is the same.

Pass-Through Tax Hikes

Finally, let’s revisit the justifications P-S identify for why Section 199A was created in the first place. Parity and economic growth were definitely in the mix, but the primary reason the Main Street community argued for rate relief was our desire to avoid a tax hike.

Starting with the Obama budget and extending through all those Camp drafts, Paul Ryan’s efforts when he chaired Ways and Means, and finally the Brady draft, Main Street correctly argued that the base broadening included in the corporate reforms would result in a tax hike on the pass-through sector. It’s our tax base too, after all. TCJA base broadeners that raise taxes on pass-throughs included:

- SALT Cap

- Section 163(j) Interest Deduction Cap

- Section 461(l) Loss Limitation Rules

- Section 212 Deduction Limitations

- Section 199 Manufacturing Deduction Repeal

- Section 174 R&E Amortization

Those tax hikes are preserved in the P-S plan without the Section 199A deduction to help offset them. The P-S plan would make the pass-through tax base broader and their rates higher than pre-TCJA.

Full Circle

We are in danger of coming full circle here. Pre-1986 tax reform, the C corporation was the tax shelter of choice; every rich person had one. They would earn their income in the C corporation and then load up the company with as many personal expenses as possible – apartments, cars, trips, whatever they could get away with. The goal was to apply the lower corporate rate to a smaller base of income.

This gaming ended post-86 when rates on individuals, pass-throughs and C corporations were consolidated into the same neighborhood (for a while, the top rates were even the same). The result was the abandonment of the C corporation shelter and a massive shift of business activity into the superior pass-through form.

Now P-S and their colleagues would return us to the bad old days of tax cheating C corporations. It’s not an improvement, and it’s going to hurt most of the country. Congress should reject this approach.