Washington Wire

Fiscal Cliff Gets Renewed Focus

In a sign that lawmakers are not content simply waiting until next year to address a litany of scheduled tax hikes, House Ways & Means Committee Chairman Jason Smith yesterday announced a series of “tax teams” tasked with identifying legislative solutions to avert the 2025 fiscal cliff.

Ten groups in total, each comprised of at least give Republicans from the panel, will address a specific policy area, from manufacturing to global competitiveness.

The team that caught …

(Read More)

Support CTA Relief

The House Small Business Committee is holding a hearing on the Corporate Transparency Act later this month. One witness will be Carol Roth, a bestselling author and small business advocate who has helped lead the charge against the poorly crafted law.

We’ve covered the CTA at length over the past few years but the bottom line is that while reporting under the CTA started already and the deadline is the year’s end, only …

(Read More)

Main Street on the Hill

S-Corp and its friends at the National Federation of Independent Business hosted a Tax Day briefing for Hill staff and other stakeholders yesterday. The topic: the massive tax hikes threatening Main Street at the end of 2025.

As readers know, the expiration of the Section 199A deduction coupled with significant increases in the marginal rates paid by the 95 percent of businesses nationwide is a significant challenge …

(Read More)

199A Takes Center Stage

As we wrote earlier this week, it’s a busy April for tax policy. The packed agenda kicked off Tuesday with a hearing at the House Small Business Committee entitled, “Exploring the Adverse Effects of High Taxes and a Complex Tax Code.” It was the perfect opportunity to highlight the tax priorities that are top of mind for the Main Street business community and did not disappoint.

The hearing had a number of high points …

(Read More)

A Taxing Month for Lawmakers

Congress is back in session this week for what promises to be a busy April for tax policy. Here is a quick overview of what’s happening.

Smith-Wyden Bill in Senate

The big-ticket item is the $80 billion Tax Relief for American Families and Workers Act. This bill easily passed the House back in January but has remained stalled in the Senate since.

That’s largely due to Republican tax writers’ objections over the structure of the child tax credit, …

(Read More)

C Corps for Everybody?

S-Corp’s mantra for tax reform is “S corps for everybody!” Tax all businesses once, tax them when the money is earned, tax them at a reasonable rate, and then leave them alone. In other words, tax them like S corporations. Moving the Tax Code towards what we call a “single tax system” would level the playing field for all types of businesses while eliminating the complexity and distortions created by the double corporate tax.

This …

(Read More)

Time to Pause the CTA

The Main Street business community came out in force today calling on Congress to enact the Protect Small Business and Prevent Illicit Financial Activity Act (S. 3625). The legislation, championed by Senator Tim Scott (R-NC), would delay by one year the onerous Corporate Transparency Act (CTA) filing requirements and accompanying jail time and penalties. A similar bill sponsored by Representatives Zach Nunn (R-IA) and Joyce Beatty (D-OH) passed the House late last year …

(Read More)

More than a Dime’s Worth of Difference

Two events took place this week which demonstrate just how remarkably divergent the potential paths of tax policy are next year.

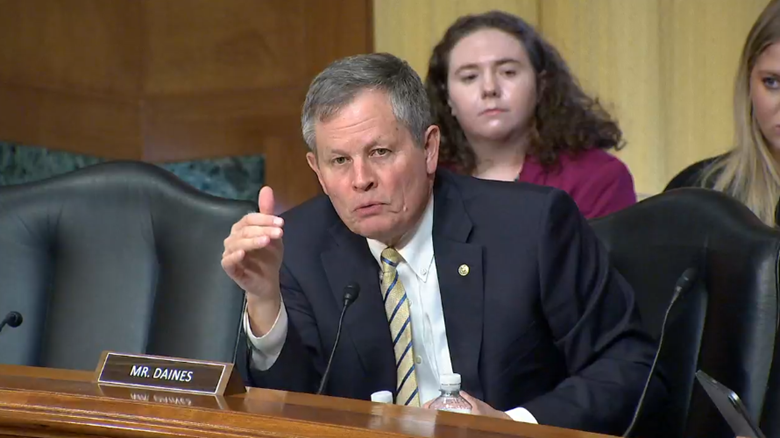

First, the Senate Finance Committee held a rare hearing Tuesday on the challenges faced by American manufacturers. Senator Steve Daines (R-MT) took the opportunity to highlight the importance of 199A to his manufacturers in Montana and how Congress needs to act to make it permanent.

…

…